Direct Investment Opportunities

Real Opportunities. Real Value.

Premium U.S. real estate investment opportunities now available to individual investors. LCP is opening its portfolio to investors with only a $100,000 minimum investment.

Why partner with lcp?

We provide access to premium real estate opportunities that yield attractive risk-adjusted returns to meet the unique investment goals of our investors.

Exclusive Opportunities

Our unique offerings include both debt and equity investments that provide investors an opportunity to choose the preferred level of risk and return they are seeking on their capital.

Unparalleled Expertise

We conduct rigorous financial analysis and valuation modeling when underwriting investment properties and determining the viability of potential acquisitions and development opportunities.

Industry Experience

LCP’s leaders are University of Pennsylvania and Yale alumni and have more than 45 years of experience sourcing and structuring more than $10 billion across all real estate asset classes.

WHAT INVESTMENT STRATEGIES ARE AVAILABLE?

As a partner to a mix of institutional and retail investors, LCP structures investments across all real estate sectors. Investments may be in the form of senior debt, junior debt, mezzanine debt, preferred equity, or common equity, and the level of projected risk and return will vary depending on the type of investment chosen.

Hotel

LCP has 45 years of experience in the development and acquisition of premium branded select- and full-service hospitality properties in the U.S

Value-Add Office Buildings

LCP spun out a portion of its portfolio to form Lexington Realty Trust (NYSE: LXP). Today, LCP targets buildings that can be acquired at significant discounts to replacement cost.

Multi-Family Residential

LCP invests in new properties as well as existing properties where it seeks to add value through renovation and capital investment in order to increase rents and occupancy.

Land

LCP invests in long-term leased fee positions as a means of generating consistent cash-on-cash returns and as a vehicle for long-term wealth creation for our investors.

Single Tenant Net Leased Properties

LCP invests in strategically positioned commercial properties with proven tenants that have strong underlying credit.

Ground-Up Development

LCP partners with leading developers in the ground-up development of new properties located in the path of economic growth.

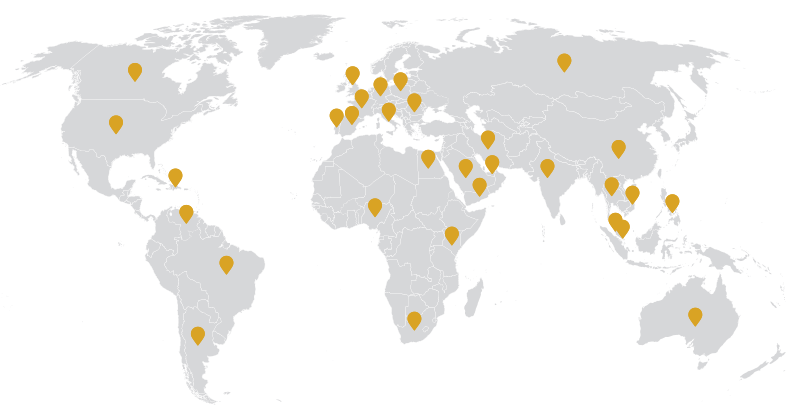

WHO INVESTS WITH LCP?

LCP has attracted institutional, retail, and high net worth investors from around the world due to solid investment projects that feature attractive risk-adjusted returns.

- Argentina

- Australia

- Bahrain

- Brazil

- Canada

- China

- Dominican Republic

- Egypt

- France

- Germany

- India

- Iran

- Italy

- Malaysia

- Kenya

- Nigeria

- Philippines

- Poland

- Portugal

- Romania

- Russia

- Saudi Arabia

- Singapore

- South Africa

- South Korea

- Spain

- Thailand

- United Kingdom

- Venezuela

- Vietnam

- Yemen

HIGHLIGHTED PROJECT:

bio365, Colorado Springs, Colorado

LCP’s latest EB-5 project is a build-to-suit manufacturing facility in Colorado Springs, Colorado. An affiliate of LCP will acquire, develop and lease the property to a single tenant, bio365, for a 25-year term. Bio365 is a high growth, patented soil manufacturer for Controlled Environmental Agriculture (“CEA”) with a strong pipeline and high conversion rate and a clear path to growth.

The strategic location of Colorado Springs is home to diverse manufacturing facilities with over 400 manufacturers located in the region. Located in warehouse supply-constrained location, demand for light-industrial warehouses will continue to grow.

Aside from the positive macro trends, Colorado Springs also presents strong local fundamentals. It was voted the Most Desirable Place to Live by U.S. News & World Report in 2018 and 2019. A forecast by Realtor.com ranks Colorado Springs as No. 7 among the nation’s Top 10 housing markets for 2020. Colorado Springs is among the top cities for tech talent growth, ranked No. 4 on CBRE’s Annual List of Up-and-Coming Tech Markets.

Projected information subject to change. *The final IRR may differ from that of the projections based on several assumptions made by the GP, including but not limited to (i) the total amount raised in the Fund which may expand the number of projects the Fund can complete, (ii) the duration required to complete any particular project, (iii) the degree of leverage used across one or all projects, (iv) the capitalization rate and value of the asset at the time of exit, and (v) the value of the bio365 warrants at the time of exit).

Qualified investors can invest directly in our projects. Contact our professional team to learn more about our opportunities.